Affirming the Importance of the

Tax Reform for Acceleration and Inclusion (TRAIN)

Leonor Magtolis Briones

Secretary, Department of Education

July 25, 2018

At the 26th Cabinet Meeting held last June 11, 2018, among the agenda items discussed was the updates on the implementation of the Tax Reform for Acceleration and Inclusion, or the TRAIN law. When the suggestion from various quarters to suspend TRAIN was mentioned, Secretary Diokno warned against two unfavorable scenarios if this is allowed: either we cut government spending, or increase borrowing.

The government has three choices in a fiscal dilemma: (1) reduce expenditures; (2) increase borrowing; or (3) increase the government’s revenue through taxation. I remarked that I will be the first to protest if the expenditures for the social sector will be reduced, because the demands of the social sector are increasing very rapidly.

This commentary explains my support to TRAIN as a contribution to informed public policy discussion on the matter. I divide this into four parts. First, I will review the key components of TRAIN. Second, I discuss its main policy objectives. Third, I will share my assessment of the rise in inflation in relation to TRAIN. Finally, I argue that people need to change their mindset that taxes are essentially tools of oppression.

The Components of TRAIN

For common reference, we review the major components of TRAIN.

The first major component of TRAIN is the provision of a significant tax relief to individual income earners. The income tax for taxable compensation income up to PhP250,000.00 per annum (PhP20,833.00 a month) was imposed a tax rate of zero, freeing this from the five brackets in the previous tax schedule. Individuals earning income from business or practice of profession below the threshold of PhP3,000,000.00 in gross receipts also get income tax relief, with the option of being taxed 8% in place of the double tax of graduated rate and percentage tax. For compensation income earners, the higher tax burden only starts to kick in at the highest income bracket of over PhP8,000,000.00 in taxable income.

The second major component of TRAIN is the imposition of or increase in the excise taxes of a number of goods. The excise taxes per liter or kilogram of manufactured oils and fuels has been increased this year, and will progressively increase yearly through 2020. A new excise tax is imposed per liter volume of sweetened beverages. There is increase and simplification of ad valorem excise tax on automobile. The excise tax per pack of cigarettes was increased in 2018, and in succeeding years through 2023, and a yearly percentage increase is prescribed thereafter. Excise tax increases were also imposed on certain mineral products, including coal.

The third major component is the limiting of VAT exemptions, while the fourth major component is the various tax administration improvements for better monitoring and compliance.

The fifth major component is the earmarking of the yearly incremental revenue from TRAIN, for a period of five years, to the Build, Build, Build Program, sugar industry development, social mitigating measures and investments, and social welfare and benefits program for low income groups.

TRAIN’s Policy Objectives

“Tax Reform for Acceleration and Inclusion” captures the policy objectives of TRAIN.

The “inclusion” part pertains to affording most of our income earners with tax relief through the reform of the income tax schedule. Imposing zero tax rate for taxable income up to PhP250,000.00 per year immediately benefits 83% of income taxpayers in the country. This includes 461,695 Teacher I and Teacher II level teachers. Those with higher taxable income will also receive tax relief, while only the highest income bracket of over PhP8,000,000.00 will be imposed higher income tax.

The recovery of the revenue loss from income tax relief, with enough to result in net revenue increase, represents the “acceleration” part. Of the incremental revenue from train for the next five years, 70% will go to infrastructure to address the much needed catch-up with the infrastructure backlog that has constrained the rate of our economic transformation. Social investments is not overlooked, with it sharing in the remaining 30% of the incremental revenue from TRAIN.

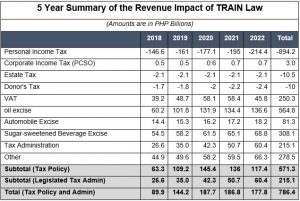

The revenue impact of TRAIN for the next five years is summarized in Table 1.

Mindful that the lowest income earners are already exempt from income taxes prior to TRAIN, and that they share in the burden of the increased excise taxes, TRAIN mandated a number of social mitigation measures for the lowest income earners. An Unconditional Cash Transfer of PhP200.00 per month for the first year and PhP300.00 per month for the second and third years, is given to households within the first to seventh income deciles in the data of the National Household Targeting System for Poverty Reduction. Fuel vouchers for qualified franchise holders of Public Utility Jeepneys are being readied. For minimum wage earners and the poorest 50% of the population, a 10% discount on fare for public utility vehicles as well as for purchase of NFA rice, and free skills training from TESDA, are mandated.

Table 1

SOURCE: Department of Finance

TRAIN in the Context of the Present Inflation

As gleaned from above, TRAIN was designed to be a package. It combines reliefs and mitigation elements with increase in excise taxes, reduction in VAT exclusions, and improvements in administration to generate a net revenue gain for government. In turn, the net revenue gain supports needed spending to accelerate economic transformation.

To be sure, the inflation effect of TRAIN was factored in the program. However, what caught the attention of the public, the media, analysts, and policymakers is the higher-than-target inflation we are experiencing. The average inflation for the first six months of 2018 has risen to 4.3%. This is higher than the National Government’s announced target inflation range of 3.0 percent +/- 1.0 percentage point for the year (or a lower-end of 2% and higher-end of 4%). What has further alarmed many is the rising trend, so far increasing to 5.2% as of June. (See Table 2)

Table 2

/a average for the first six months

SOURCE: PSA

Amid polarized discussions on the present level of inflation, I make the following contribution:

- It is wrong to singularly blame TRAIN for the inflation.

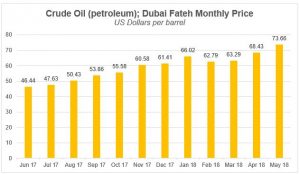

A closer examination of the drivers of the inflation show that external factors played a major role. The world price of crude oil has risen considerably from year-ago level, and particularly at a fast rate in the last quarter. (See Figure 1)

Figure 1

SOURCE: IndexMundi (downloaded from www.indexmundi.com/commodities/?commodity=crude-oil-dubai&months=12)

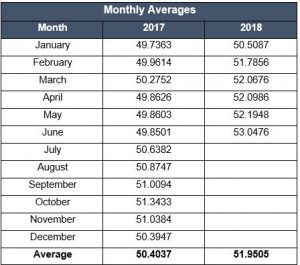

The domestic price of imported crude/fuel is also affected by the depreciation of the peso, which the BSP attributed to US Fed rate increase and trade tensions between the US and its trading partners. (See Table 3)

Table 3

SOURCE: BSP

At the domestic front, factors other than TRAIN, such as the delay in rice importation, and weather-related disturbances, also affected prices of volatile food items.

- Inflation becomes really worrisome when associated with an economy spiraling into crisis, which the Philippine economy is not.

Philippine GDP grew by 6.8% (year-on-year) in the first quarter of the year, faster than the 6.5% recorded in the same quarter last year. Industry remains the fastest growing for the first quarter (7.9%), followed by services (7.0 %).

All three major international credit rating agencies – Moody’s, Fitch, and Standard and Poor’s – have maintained a stable credit rating for the Philippines. S&P notes in its release dated April 26, 2018, that the Philippines “has a strong external position, and improving policymaking in recent years has contributed to sustainable public finances, as well as solid economic growth.” More recently, Moody’s in July 20, 2018, explained that its Baa2 rating for the Philippines “incorporates a number of very positive credit features, including the high economic strength derived from a large and fast-growing economy, as well as improving fiscal strength based on moderate government debt levels and gains in debt affordability.” Fitch, in affirming the Philippines’ BBB rating, noted that “revenue improvement should help preserve fiscal stability as government expenditures increases under the planned public investment programme, which aims to raise the government’s capital expenditure to 7.3% of GDP by 2022 from 6.1% in 2018.”

- Suspending any revenue generator of TRAIN at this point will do more harm than good.

There have been suggestions to suspend the excise tax on fuel under TRAIN to cope with the inflationary pressure. However, to suspend one of the major revenue generators of TRAIN will have dire results in the revenue performance of government, given that the tax relief components will remain. This will put in jeopardy the expenditure requirements that rely on TRAIN. Ironically, as mentioned above, TRAIN is one of the positive factors accounting for the stable credit rating of the government.

It should be noted that TRAIN itself already has a built-in mechanism to meet an external contingency of the world price of petroleum reaching very high levels. It provides: “For the period covering 2018 to 2020, the scheduled increase in the excise tax on fuel as imposed in this section shall be suspended when the average Dubai crude oil price based on Mean of Platts Singapore (MOPS) for three (3) months prior to the scheduled increase of the month reaches or exceeds Eighty dollars (USD 80) per barrel.”

- However, the painful impact of inflation on the lower income groups is real, and the government is doing all it can to alleviate their plight.

The public can be assured that government takes very seriously the impact of inflation on lower income groups. The appropriate agencies, such as DOF and the BSP, have been monitoring this very closely, and are exerting all efforts to mitigate the impact. There has been directives on the agencies in charge of the social mitigation measures to expedite the implementation of these programs. BSP, for its part, has responded through its policy instruments, such as by raising key policy rates to temper price pressures.

The Public Needs to Change its Mindset on Taxes

A complicating factor in discussions on TRAIN is the general attitude of the public on taxes in general. As I mentioned earlier, the public mindset is that taxes are invariably tools of oppression. This makes an anti-tax stance by politicians popular. Similarly, political groups reinforce the anti-tax sentiment to generate public support for their advocacies.

On the other hand, the public demands ever increasing public goods and services, whether infrastructure, education, health, or disaster relief. The expectation and presumption is that the government has unlimited resources to finance these goods and services. The public will not pause to look where such funds come from.

We all need to come to terms with the fact that the main source of funds to finance public goods and services is taxes. There is, more often than not, a fundamental contradiction in a position that says no to taxes but demands increasing provision of public goods and services.

Beyond its immediate objectives, TRAIN must be understood with respect to its contribution to improving the government’s long term revenue position.

In terms of Build, Build, Build, large infrastructure projects, by nature, are put up through project financing. These require longer repayment period, and TRAIN is an important component to ensure that the government is able to afford this not only under this administration but also for succeeding ones.

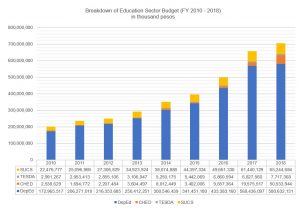

In terms of the social sectors, education has been a major beneficiary of fiscal expansion in recent years, and we need to sustain this into the future. As shown in Figure 2, the budget for the education sector has increased considerably from 2010 to 2018, from PhP200.9 billion in 2010, to PhP704.1 billion in 2018.

Figure 2

SOURCE: DBM

DepEd accounts for the largest share in the education budget. We have used our funds not only to pay the salaries of our existing teachers, but also for new teachers items, teacher training, learning resources, ICT packages, Science and Math equipment, workshops and laboratories, and TVL tools and equipment. It is also used to run programs such as school-based feeding for elementary students, Alternative Learning System (ALS) program to target out-of-school youth, and ESC and voucher program to support the education of secondary students in private schools.

These education inputs have resulted in significant improvements in access, with high participation and completion rates, and lowering of dropout rates. This year, we graduated our first batch of more than 1.2 million Senior High School students. While there remain challenges in SHS implementation, the initial results have exceeded our expectations. SHS graduates who may opt to seek employment have better prospects than previous high school graduates because of work immersion, a key feature of the curriculum. In addition, learners in the TVL track who have acquired national certification from TESDA-accredited assessment have better employment opportunities.

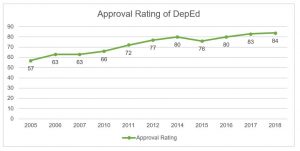

The accomplishments of DepEd is being recognized by the people. Based on the Pulse Asia March 2018 Ulat ng Bayan survey, DepEd’s March year-on-year approval rating has reached the highest since 2005, at 84% in March 2018. This is the numerically highest approval rating among the Executive departments rated for the period. (See Figure 3)

While recognizing the gains, we hope that the people will realize that the education services they enjoy are funded by taxes, and that TRAIN is needed to sustain these services. At the same time, there is the constant challenge to all of us to watch where our taxes go.

Figure 3

SOURCE: Pulse Asia

Conclusion

TRAIN is a package where the sum is greater than its parts. Taken together, TRAIN is pro-poor and pro-development. It gives relief to majority of income earners, while generating funds for important economic and social services. TRAIN also includes targeted social mitigation measures to alleviate the burden that may be experienced by the lower income groups.

At present, the value of TRAIN is being undermined by critics who singularly fault it for the higher than target inflation we are experiencing presently. This is misleading, considering the external factors that also drive inflation. The inflation also remains manageable in the context of the favorable overall economic health of the country, as affirmed by international credit rating institutions.

The pain of inflation to lower income groups is recognized, and is seriously being addressed by government. The Executive has directed the agencies in charge of the social mitigation measures to expedite implementation. BSP is also introducing measures to temper prices. The relevant agencies are closely monitoring the situation, in case more drastic actions are needed.

In dealing with taxation, the mindset of the public that taxes are necessarily oppressive must change. We must all realize that there is no magical source of government resources; its funds come mainly from taxes. In turn, it is this funds that are used to provide essential goods and services. Education is a major beneficiary of the fiscal expansion, and people recognize the gains. It is high time we recognize that we need taxes to sustain this into the future.

At the same time that we change our mindset about taxes, there is the constant challenge to all of us to watch where our taxes go. Our motto is “Pera ng bayan, para sa bayan”. This government is committed to make sure that the taxes you pay will go where they should.

– End –

Publicly delivered at a Press Briefing on July 25, 2018

Malacañang Press Briefing room

New Executive Building

Available at: https://web.facebook.com/pcoogov/videos/507556789703800/?_rdc=1&_rdr

http://www.deped.gov.ph/wp-content/uploads/2018/07/SLMB-TRAIN-25-July-2018.pdf